inheritance tax changes 2021 uk

Currently each person has a nil rate band NRB of 325000 up to which there is a 0 charge to IHT. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

Death And Taxes In Portugal The Portugal News

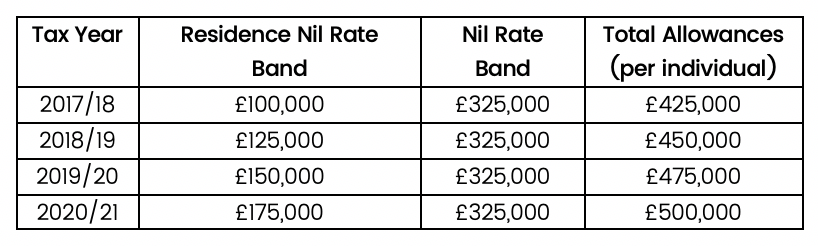

In April 2017 the Government introduced an additional nil-rate band when a residence is passed on death to a direct descendant.

. The limit for chargeable trust property is increased from 150000 to 250000. Instead the donee will take over the base costs of the donor. The spousalcivil partnercharity limit for an excepted estate will triple so will increase from 1000000 to 3000000.

The person died on January 2 2022 leaving an estate worth 285000 which is below the inheritance tax threshold. For married couples they benefit from a cumulative NRB of 650000 2 x 325000. Income tax allowance.

Following the announcement to freeze a number of tax thresholds at Budget 2021 the NRB is set to remain at that level until at least 5 April 2026. Inheritance Tax Changes in 2022. For exempt estates the value limit in relation to the gross.

If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate. In addition to this there exists the residence nil rate band which is currently 150000 per person soon to be 175000 for the 20202021 tax year. The residence nil rate band RNRB has increased by 25000 each year since its.

Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate. This is called entrepreneurs relief.

A married couple can therefore raise. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported. Capital Gains Tax Rate UK 2021.

Budget 2021 - Changes to Inheritance Tax. As announced in the 2021 Autumn Budget many taxpayers will soon see higher tax bills for dividend income along with National Insurance hikes - despite calls for the government to call them off. The residence nil rate band RNRB was due to start increasing in line with inflation from the beginning.

In addition the residence nil-rate band will also be frozen at 175000When added to the IHT threshold of 325000 it allows each individual to pass on 500000 with no IHT payable - or 1m per. The Government has previously announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20212022. Its only charged on the part of your estate thats above the threshold.

The tax body stated. The new legislation includes the following changes. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost.

The changes are delivered by amending the Inheritance Tax Delivery of. Tax rates and allowances. This allowance is the amount of money you can earn before.

There are also changes to be aware of if you make a capital gain or have to pay inheritance tax on someones estate. With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances. The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021.

The rate remains at 40. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed. Example Your estate is worth 500000 and your tax-free threshold is.

Only six states actually impose this tax. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

The standard Inheritance Tax rate is 40. Initially this was set at 100000 but rises to 175000 in. The inheritance tax IHT nil rate band NRB has been at its current level of 325000 since 6 April 2009.

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating. It has been suggested that income tax rates will be raised to as much as 45 and it is likely the CGT will increase to match it.

Use your 12300 allowance which cannot be carried forward to future years. One of the biggest announcements in Rishi Sunaks budget was that the tax-free personal allowance will be frozen. In March 2021 the government announced changes in IHT which will become effective from January 2022.

The aim is that from 1 January 2022 more than 90 of non-taxpaying estates will no longer have to complete a full inheritance tax IHT account when probate or confirmation is required. Often referred to colloquially as death tax it is a levy that is placed on estates that are worth more than the IHT threshold. To reduce your Capital Gains Tax bill here are some practical steps.

15 October 2021 1423. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. If the deceased held assets in a trust the limit of.

For lifetime gifts there would be no capital gains tax on the gift. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. The requirement for completing the IHT205 and IHT217 forms is being scrapped for all estates classed as excepted.

Why Should We Care About Inheritance Tax The Independent

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

15 Ways To Avoid Inheritance Tax In 2022 Youtube

What Is Inheritance Tax Nerdwallet Uk

Will Uk Inheritance Tax Increase Because Of Covid 19 Stellar Am

Inheritance Tax Receipts Uk 2022 Statista

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

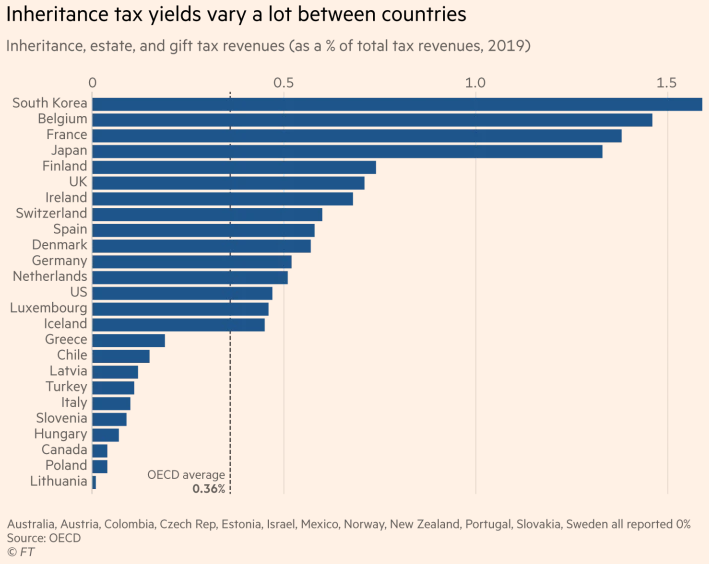

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

401 K Inheritance Tax Rules Estate Planning

How Can I Reduce My Inheritance Tax Bill Times Money Mentor

Inheritance Tax Planning May 2022 Uk Guide

Inheritance Tax Guide For Property Investors Landlords

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

Inheritance Tax Debate What The Wealthy Need To Know

Pfp The Rise And Rise Of Inheritance Tax

A Guide To Inheritance Tax Forms

Life Insurance And Inheritance Tax Forbes Advisor Uk

Inheritance Tax Planning How A Pension Can Shield Your Estate From Inheritance Tax Moneyweek